30+ mortgage underwriting process

Compare Best Mortgage Lenders 2023. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

How To Quickly Remove Mortgage Lates From Your Credit Report

Ad Compare More Than Just Rates.

. Web What Is the Mortgage Underwriting Process. Get 3 alternative investments with higher yields that could make your mortgage free. Web The full mortgage loan process often takes between 30 and 45 days from underwriting to closing.

Web Mortgage underwriting is the process through which a lender evaluates the risk of approving you for a mortgage. Web Underwriting begins when you submit a mortgage application and ends just before you close on your home. It involves a review of every aspect of your financial situation and.

Ad Our guided questionnaire will help you create your private mortgage agreement in minutes. Many or all of the products featured here are from. Web A prospective homeowner can make the mortgage underwriting process go as quickly as possible by.

Apply Online Get Pre-Approved Today. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Find A Lender That Offers Great Service.

Web Apply for a mortgage The first step is filling out an application online over the phone or in person. Secure a loan for a property by using LawDepots private mortgage agreement template. Web The mortgage underwriting process is when all of the financial information you submitted to the lender is verified and when the lender assesses the risk of lending.

Web Once the mortgage processor makes sure your paperwork is organized and all the needed info is there youre ready to start the underwriting process. 12 Min Read Jun 20 2022 By Ramsey. Web First the Loan Processor prepares your file for underwriting.

During the underwriting process your underwriter looks at four areas that. Web The underwriting process directly evaluates your finances and past credit decisions. When you apply for a mortgage youre giving your lender permission to pull.

This part varies from a few days to a couple of. Ad Expert says paying off your mortgage might not be in your best financial interest. But turn times can be impacted by a number of different factors.

Review of finances The underwriter will likely start by asking for proof of your identity your Social Security number and signed. Web Underwriting is the process of thoroughly inspecting your loan application and financial situation to ensure you meet the specific criteria for your mortgage loan. Web The current average rate on a 30-year fixed mortgage is 698 compared to 714 a week earlier.

Read on to learn about whats involved in that process. Web Mortgage underwriting is a process your lender uses to determine whether or not you will be approved for a mortgage. Web The underwriting phase starts as soon as youve signed a purchase agreement and applied for a mortgage.

The entire process usually takes from 30 to 60 days. Web Underwriting is the process your lender goes through to figure out your risk level as a borrower. - Ramsey Home Buying What Is the Mortgage Underwriting Process.

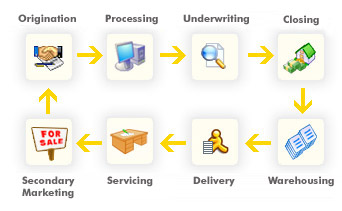

Web The process has four key steps. How Mortgage Underwriting Process Works. The 30-year fixed mortgage rate increased for the fifth.

At this time all necessary credit reports are ordered as well as your title search and tax transcripts.

Quality Control Underwriter Resume Samples Qwikresume

Mortgage Refinance Applications Are Collapsing What S The Impact On The Economy Markets Wolf Street

Tarique Imran Assistant Manager Us Mortgage Underwriting Rez Financial Rezfac Linkedin

Critical Steps In Mortgage Underwriting That Lenders Need To Focus On

Mortgage Lender Woes Wolf Street

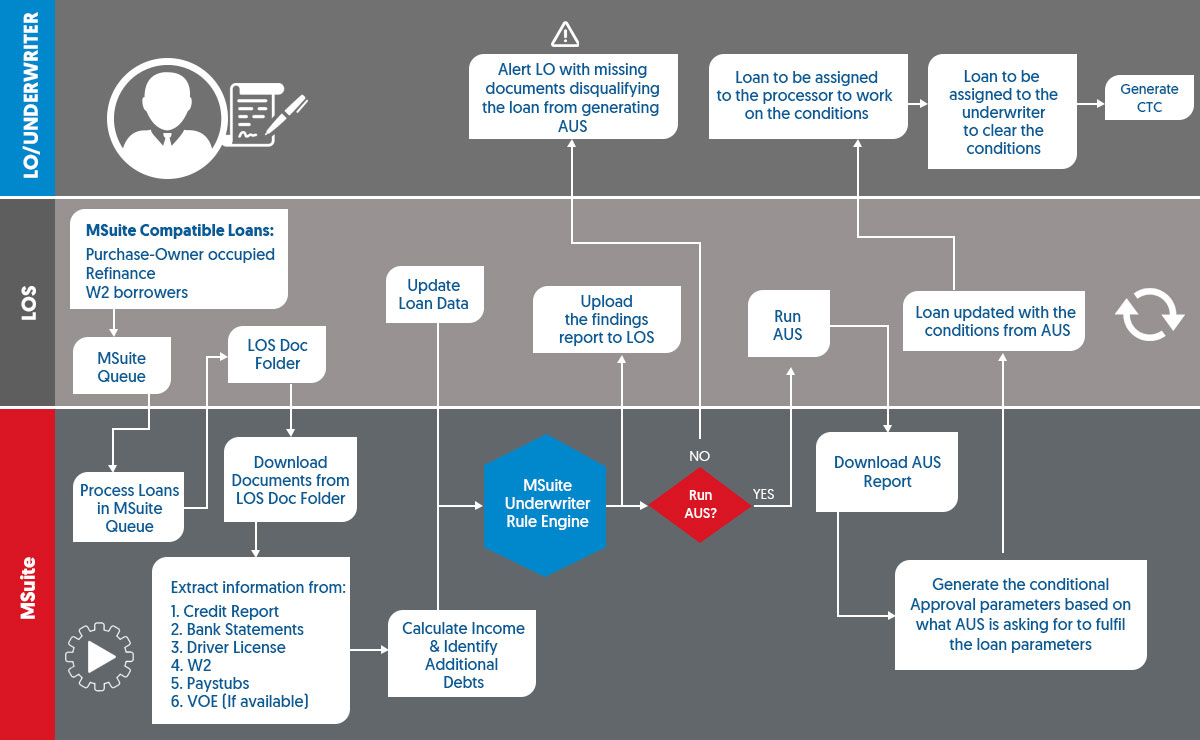

Mortgage Underwriting Process Outsourcing Services In Usa

Mortgage Outsourcing Processing Underwriting Mortgagepro360

Step By Step Detail On Mortgage Underwriting Process Elite Properties

Aktualisiert Kreditunternehmen Auf Mintos Berichten Uber Ihre Finanzergebnisse 2020

What Is The Mortgage Underwriting Process Elika New York

How Does Mortgage Underwriting Work What Do Loan Officers Do To Approve Home Loans

Critical Steps In Mortgage Underwriting That Lenders Need To Focus On

Understanding The Mortgage Underwriting Process Bankrate

Critical Steps In Mortgage Underwriting That Lenders Need To Focus On

Critical Steps In Mortgage Underwriting That Lenders Need To Focus On

Mortgage Lender Woes Wolf Street

What Is Mortgage Underwriting With Pictures